Mortgage rates moderated this week after posting a big drop last week, and the Federal Reserve’s decision on Wednesday to raise its short-term key interest rate hasn't had much on an effect on rates. (The Fed’s key rate is not directly tied to mortgage rates, but does often influence it.)

“The response to the recent decline in mortgage rates is already being felt in the housing market,” says Sam Khater, Freddie Mac’s chief economist. “After declining for six consecutive months, existing home sales finally rose in October and November and are essentially at the same level as during the summer months. This modest rebound in sales indicates that home buyers are very sensitive to mortgage rate changes—and given the further drop in rates we’ve seen this month, we expect to see a modest rebound in home sales as well.”

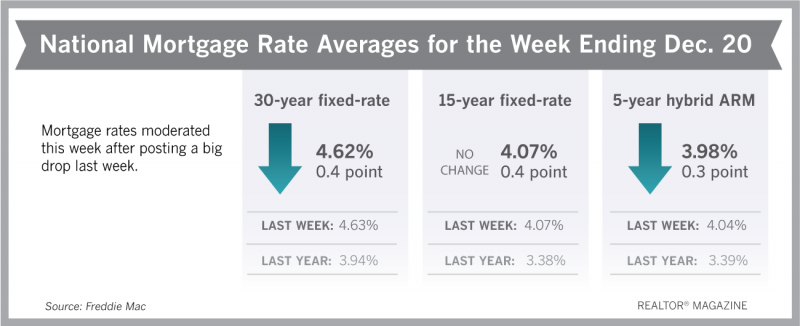

Freddie Mac reports the following national averages with mortgage rates for the week ending Dec. 20:

- 30-year fixed-rate mortgages: averaged 4.62 percent, with an average 0.4 point, dropping slightly from last week’s 4.63 percent average. Last year at this time, 30-year rates averaged 3.94 percent.

- 15-year fixed-rate mortgages: averaged 4.07 percent, with an average 0.4 point, unchanged from last week. A year ago, 15-year rates averaged 3.38 percent.

- 5-year hybrid adjustable-rate mortgages: averaged 3.98 percent, with an average 0.3 point, falling from last week’s 4.04 percent average. A year ago, 5-year ARMs averaged 3.39 percent.

Source: Freddie Mac